Certified Mortgage Blog

Where You Can Find Latest Mortgage News in Canada

Local, Toronto Mortgage Brokers With Offices In Ottawa And Hamilton!

... We Will Do Our Best to Close on Time, Headache Free, with Best Possible Rate

The Latest Mortgage News and Findings in Canada

Posted November 08, 2018

Posted November 08, 2018

We’ve compiled the bevy of reports and surveys completed throughout the past two weeks in regards to borrowing, the financial state of consumers, and the real estate market. Read below for a breakdown and mortgage news of what’s going on in the aforementioned avenues: Amidst Rigid Mortgage Rules, GTA Turning to Private Lenders The Homeowners in...

Toronto Homeowners Making Private Mortgage

Posted November 05, 2018

Posted November 05, 2018

Toronto’s a city filled with man buns, food trucks, Indy music, and whatever else is the trend of the day. Unfortunately, its latest trend is one brought on by sky-high interest rates and increasingly difficult borrowing standards—homeowners are turning to private lenders in Ontario’s capital to get a private mortgage. Private lending shot up 67%...

Reverse Mortgage Debt Likely to Slow Down After Reaching Record High

Posted November 01, 2018

Posted November 01, 2018

The OSFI (Office of the Superintendent of Financial Institutions) has presented data proving that while reverse mortgage debt hit its a peak in August, there is actually drastic slow down compared to earlier this year. What does this mean for senior homeowners in Canada dealing with the continual decrease in their home equity? Breaking Down...

Canadian Interest Rates Reach 10 Year High

Posted October 30, 2018

Posted October 30, 2018

Borrowing costs have now increased for Canadians after the Bank of Canada initiated a quarter-point jump to the overnight target interest rates. The Bank of Canada explained that in order to achieve the inflation target, the policy interest rate must reach a neutral stance. According to the BoC, the economy is functioning at capacity and...

The debt. Don’t Rush Your Mortgage Because of Renewing Rates

Posted October 23, 2018

Posted October 23, 2018

In the time when interest rates are sky high, it’s naturally to flatly panic about renewing a larger mortgage and debt, but your concerns are unfounded. Mortgage rates are actually preferable to other borrowing methods, meaning you don’t need to be in such a hurry to pay it off. Chisel Away at Higher-Rate Debts It’s...

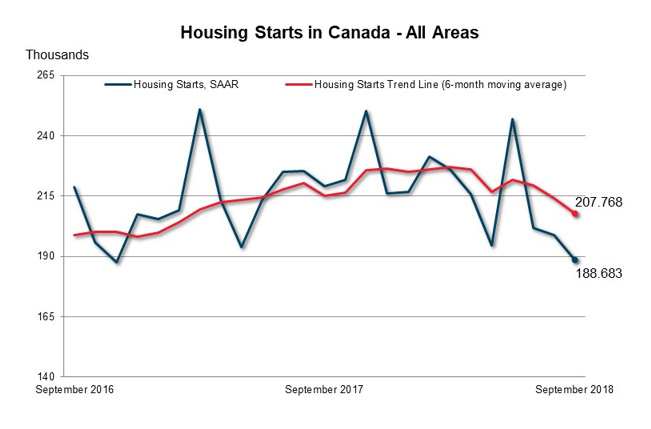

Housing Starts Trending Down for Canada in September

Posted October 16, 2018

Posted October 16, 2018

The Canada Mortgage and Housing Corporation (CMHC) reports that as of September 2018, 207,768 housing starts, trending down from August which saw over 6 thousand more housing starts. September shows a 19-month low, then after a month of a steady from in the past five months, according to CMHC’s chief economist, Bob Dugan. He believes...

MCAN Mortgage Corporation Names Karen Weaver as Interim CEO

Posted October 12, 2018

Posted October 12, 2018

As of October 9th, 2018, William Jandrisitis is no longer the president and CEO of MCAN Mortgage Corporation, a Toronto-based investment mortgage corporation, after 8 years. The Board of Directors at MCAN appointed Karen Weaver as the interim CEO for the time being until they decide on a permanent successor. Weaver, a director for “The...

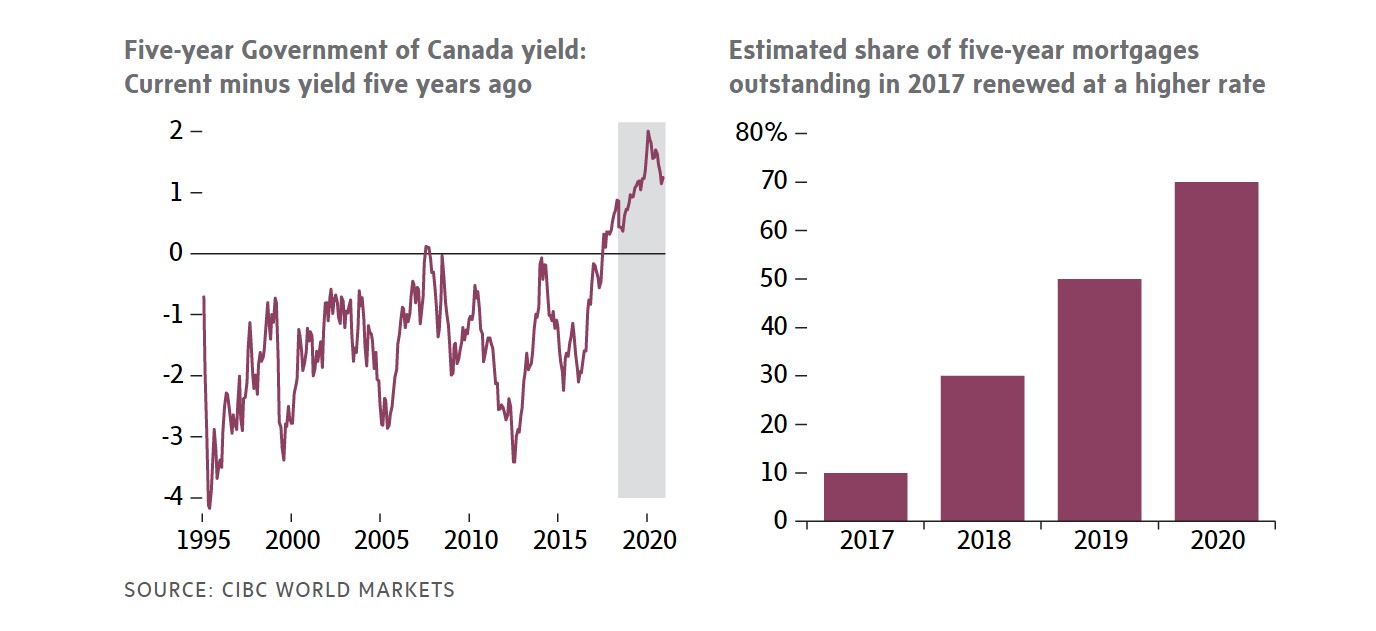

Mortgage Rates Will Have Canadians Tightening Their Belts

Posted October 02, 2018

Posted October 02, 2018

Don’t expect mortgage rates to crash back down to earth anytime in the foreseeable future. Do expect the wallets and bank accounts of Canadians to wear the rigours of financial strain come 2020, believes Royce Mendes, a senior economist at CIBC. While Mendes isn’t throwing in the towel for consumers in Canada – where...

Could This Tech-Based Lending Make Mortgage Banks and Brokers Obsolete?

Posted September 27, 2018

Posted September 27, 2018

A Bermuda-based firm has launched the Tech-Based lending – an alternative mortgage peer-to-peer lending platform connecting buyers with investors who wish to fund their loan. In direct opposition with the traditional mortgage space, the firm known as Viva Network considers themselves pioneers and innovators in finance real estate. Viva says its alternative lending platform is the...