Certified Mortgage Blog

Where You Can Find Latest Mortgage News in Canada

Local, Toronto Mortgage Brokers With Offices In Ottawa And Hamilton!

... We Will Do Our Best to Close on Time, Headache Free, with Best Possible Rate

Tough Mortgage Rules Affecting Home Builders and Young Home Buying Market

Posted December 12, 2018

Posted December 12, 2018

Home builders are displaying growing concerns over Canada’s cooling housing markets, as they plead with the federal government to ease up mortgage-lending restrictions and mortgage rules. The rigid mandates have helped garner the preferred soft landing and mortgage rates have risen sufficiently enough for the mortgage rules to subside—at least according to executives at Mattamy...

Canadian Housing Market Expected to Moderate

Posted December 07, 2018

Posted December 07, 2018

Canadian housing market should moderate during the next two years while the housing prices slow down and fall in line with economic fundamentals, according to Canada Mortgage and Housing Corporation. Housing starts and sales rates will respectively dwindle come 2019 and 2020, claims the national housing agency in its annual outlook. Single and multi-unit housing...

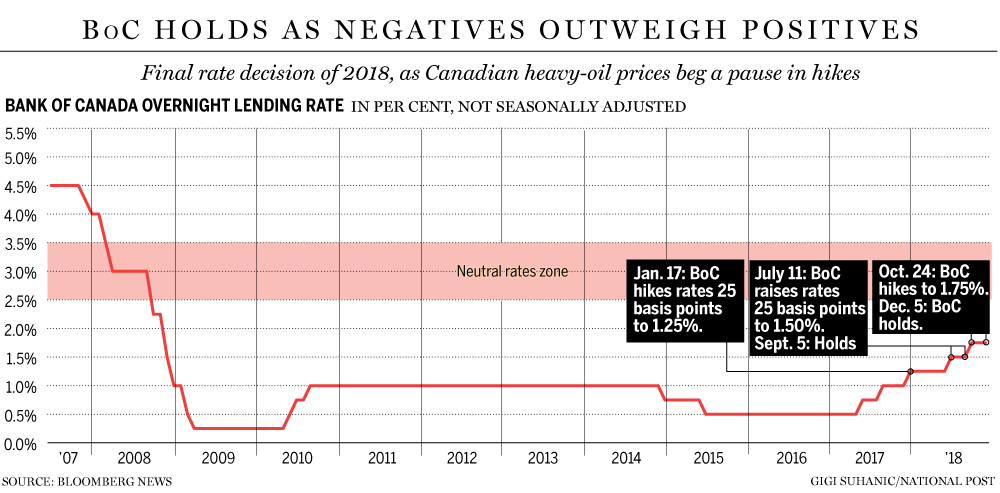

Central Bank Not Budging on 1.75% Key Interest Rate

Posted December 06, 2018

Posted December 06, 2018

While the Bank of Canada (BoC) fully assesses the full brunt of its most recent policy decisions and far lower oil prices, they explained on Wednesday their plan of maintaining the benchmark interest rate. The target for the overnight key interest rate has been 1.75% since it was elevated to such heights in October—an occurrence that’s...

Expect Mortgage Liquidity from Central Banking in the Near Future

Posted December 05, 2018

Posted December 05, 2018

Last week, in an act that’s designed to add to its assets and potentially give a nudge to the housing market, the Bank of Canada (BoC) set a plan in motion to purchased government back mortgage bonds. The fact is, it’s usually a bad omen when mortgage liquidity concerns are addressed by government institutions. What’s an...

Renewal Time Could Turn Sour for Variable-Rate Mortgages Holders

Posted November 29, 2018

Posted November 29, 2018

How can matters become even more tumultuous for those holding variable-rate mortgages? If you answered an increase in price—you are surprisingly incorrect. Instead, the far bleaker scenario is stagnant payments that don’t increase adjacent to higher borrowing costs. Unchanging payments are a sign that lenders are using a higher percentage of your payments for hiked...

Could New Stricter Mortgage Rules Help Canadian Economy?

Posted November 22, 2018

Posted November 22, 2018

It’s a scary new world out there for those seeking a Mortgage, and The Bank of Canada is doing their best to explain the higher interest rates and increasingly stringent mortgage rules forced upon Canadian home buyers and owners. On Wednesday, they explained how the new conditions have slowed down new households from becoming “deeply...

CMFG Looking to Ease Burden of Private Lending

Posted November 19, 2018

Posted November 19, 2018

Due to stringent mortgage rules and higher interest rates brought upon by the government, borrowers have had to seek private lending. Canada Mortgage & Financial Group is looking to offset the financial blow dealt with private borrowers who must deal with the more expensive private lending. With a primary focus on funding residential and construction,...

Second Mortgage Will Be Harder to Come by for HELOC-Holders

Posted November 15, 2018

Posted November 15, 2018

After Canada’s main home equity line of credit (HELOC) lender, TD Bank, recently finagled their mortgage application review process, Canadians with a HELOC need to step carefully. Especially given the special attention paid to applicants who already have a second mortgage on their home. It’s evident now that the nation’s big banks are paying attention...

Higher Interest on Mortgage Renewal is Here to Stay

Posted November 12, 2018

Posted November 12, 2018

There is a brand new phenomenon Canadian homeowners are being faced with when their mortgages come up for mortgage renewal — higher interest rates. According to TD Economics, this has never happened before. TD recently embarked on a report that investigated the transformation of the traditional five-year mortgage rate and mortgage renewal throughout the length...